Ponzi Scheme 2024: The Ultimate Guide to Protecting Yourself from Investment Scams

As we enter a new year, the world of finance is abuzz with the promise of high returns and easy wealth creation. However, beneath the gleaming surface of lucrative investment opportunities lies a sinister reality – the Ponzi scheme. This type of investment scam has been around for decades, and its impact on unsuspecting investors can be devastating. In this article, we will delve into the world of Ponzi schemes, exploring what they are, how they work, and most importantly, how to protect yourself from falling victim to these scams.

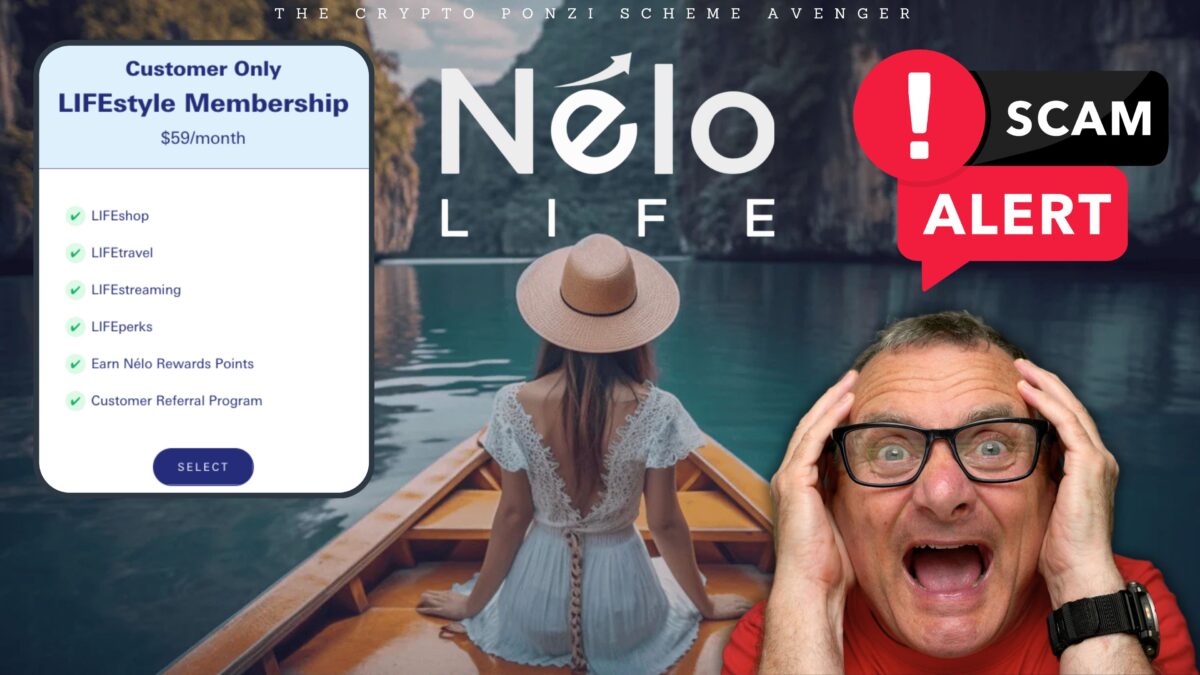

Ponzi schemes are investment scams that promise unusually high returns with little to no risk. The scammer promises that the investment will generate significant returns through a complex investment strategy or by using a supposedly lucrative business model. In reality, the returns are generated not from any actual investment or business activity, but from the money invested by subsequent victims. The scammer uses the money from new investors to pay returns to earlier investors, creating the illusion of a successful investment.

The key to a successful Ponzi scheme is the ability to create a sense of urgency and excitement around the investment opportunity. Scammers often use high-pressure sales tactics, promising investors that they will miss out on a once-in-a-lifetime opportunity if they don't invest immediately. They may also use fake credentials, testimonials, and documentation to create the illusion of a legitimate investment opportunity.

How to Identify a Ponzi Scheme

Identifying a Ponzi scheme can be challenging, especially for those who are not familiar with investment products or have a basic understanding of finance. However, there are several red flags that can indicate a Ponzi scheme. Here are some common warning signs:

- Unusually high returns with little to no risk

- Pressure to invest quickly, with a sense of urgency or scarcity

- Lack of transparency about the investment strategy or business model

- Unregistered investment products or unlicensed sellers

- Unusual or complex investment instruments

- Promises of guaranteed returns or guaranteed success

- Unwillingness to provide documentation or records of the investment

- Unrealistic or unexplained fees or charges

The Dangers of Ponzi Schemes

Ponzi schemes can have serious consequences for investors, including:

- Financial loss: Ponzi schemes can result in significant financial losses for investors, often exceeding the initial investment amount.

- Emotional distress: The shock and disappointment of losing money in a Ponzi scheme can lead to emotional distress, anxiety, and depression.

- Loss of trust: Ponzi schemes can erode trust in the financial system and the integrity of investment products.

- Regulatory implications: Ponzi schemes can lead to regulatory action, including fines, penalties, and even imprisonment for those involved.

How to Protect Yourself from Ponzi Schemes

Protecting yourself from Ponzi schemes requires a combination of education, awareness, and vigilance. Here are some tips to help you avoid falling victim to these scams:

- Educate yourself: Learn about investment products, business models, and financial markets to understand what is legitimate and what is not.

- Research the seller: Research the seller and the investment product to ensure it is registered and licensed.

- Be cautious of pressure tactics: Be wary of pressure sales tactics and take your time to make an informed decision.

- Verify information: Verify information about the investment, including the investment strategy, fees, and returns.

- Diversify your portfolio: Diversify your investment portfolio to minimize risk and maximize returns.

- Report suspicious activity: Report any suspicious activity or red flags to regulatory authorities or law enforcement agencies.

The Role of Regulators and Law Enforcement

Regulators and law enforcement agencies play a crucial role in combating Ponzi schemes. Here are some ways they can help:

- Registration and licensing: Regulators can register and license investment products and sellers to ensure they are legitimate and compliant with regulations.

- Monitoring and enforcement: Regulators can monitor the financial industry and enforce regulations to prevent Ponzi schemes.

- Investigation and prosecution: Law enforcement agencies can investigate and prosecute those involved in Ponzi schemes.

- Public awareness: Regulators and law enforcement agencies can raise public awareness about the dangers of Ponzi schemes and the importance of investing responsibly.

The Future of Ponzi Schemes in 2024

As we look to the future, it is likely that Ponzi schemes will continue to evolve and adapt to new technologies and investment products. However, with education, awareness, and vigilance, investors can protect themselves from these scams. Here are some key trends to watch in 2024:

- Rise of digital investment products: The rise of digital investment products, such as blockchain and cryptocurrency, may create new opportunities for Ponzi schemes.

- Increased regulation: Regulatory bodies may increase their scrutiny of investment products and sellers to prevent Ponzi schemes.

- Growing awareness: Public awareness of the dangers of Ponzi schemes may increase, leading to more investors taking steps to protect themselves.

Conclusion

Ponzi schemes are a significant threat to investors, causing financial loss, emotional distress, and loss of trust in the financial system. By understanding what a Ponzi scheme is, how it works, and how to protect yourself, investors can avoid falling victim to these scams. Regulators and law enforcement agencies play a crucial role in combating Ponzi schemes, and public awareness and education are key to preventing these scams in the future.

Is Tony Hinchcliff Married

Goblin Cave

Michael Mando Uality

Article Recommendations

- Kaitlyn Kremsd

- Hisashi Ouchi

- Michael Mando Uality

- Dididdy Pass Away

- London Hammer

- Katy Newcombe

- Manuel Garcia Rulfo Wife

- Colin Allredecond Wife

- Norafawn

- Juanita Tolliver Husband